How to Stay on Top of Deadlines When Submitting an Online Tax Return in Australia

How to Stay on Top of Deadlines When Submitting an Online Tax Return in Australia

Blog Article

Navigate Your Online Income Tax Return in Australia: Crucial Resources and Tips

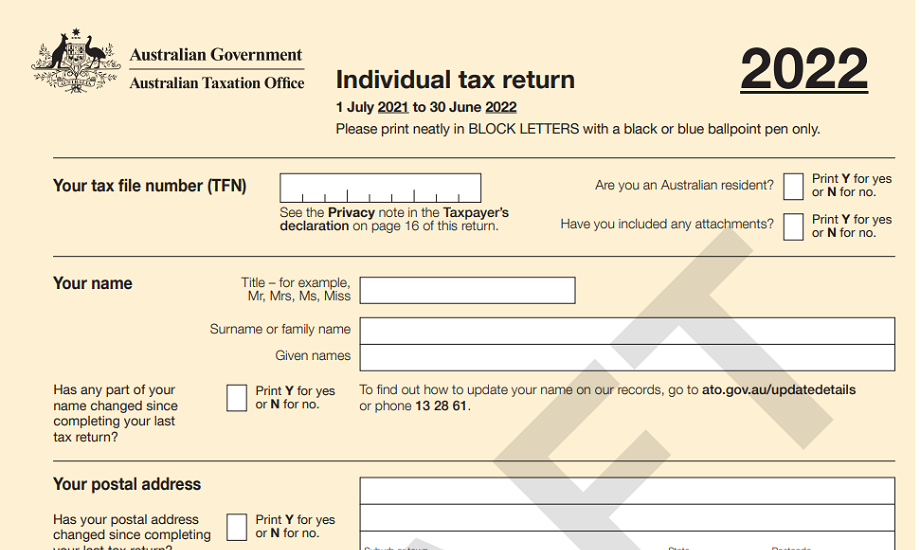

Browsing the on the internet tax obligation return procedure in Australia requires a clear understanding of your responsibilities and the resources available to simplify the experience. Vital files, such as your Tax Data Number and income declarations, need to be meticulously prepared. Picking a proper online platform can dramatically influence the effectiveness of your filing procedure.

Comprehending Tax Responsibilities

People should report their income properly, which consists of earnings, rental revenue, and investment profits, and pay tax obligations accordingly. Locals need to understand the difference in between taxable and non-taxable earnings to ensure conformity and enhance tax results.

For companies, tax commitments encompass several elements, consisting of the Product and Solutions Tax Obligation (GST), business tax obligation, and payroll tax obligation. It is essential for organizations to sign up for an Australian Organization Number (ABN) and, if appropriate, GST registration. These duties require meticulous record-keeping and timely entries of income tax return.

In addition, taxpayers need to be acquainted with available deductions and offsets that can reduce their tax burden. Inquiring from tax experts can offer beneficial insights right into maximizing tax obligation positions while making sure compliance with the regulation. In general, an extensive understanding of tax obligation commitments is vital for efficient financial planning and to stay clear of charges connected with non-compliance in Australia.

Important Files to Prepare

In addition, compile any type of pertinent bank declarations that reflect passion earnings, in addition to dividend declarations if you hold shares. If you have other resources of earnings, such as rental residential or commercial properties or freelance job, ensure you have documents of these profits and any kind of associated expenses.

Don't neglect to include reductions for which you may be qualified. This may include receipts for occupational expenditures, education and learning expenses, or charitable contributions. Think about any kind of exclusive health and wellness insurance declarations, as these can influence your tax obligations. By gathering these crucial papers in advance, you will certainly enhance your on-line tax return process, minimize mistakes, and optimize possible refunds.

Picking the Right Online System

As you prepare to file your online tax return in Australia, selecting the appropriate platform is important to make certain accuracy and ease of usage. A number of essential elements need to assist your decision-making process. Think about the system's customer interface. A straightforward, instinctive layout can considerably boost your experience, making it much easier to navigate intricate tax return.

Following, analyze the system's compatibility with your monetary scenario. Some solutions provide specifically to people with basic income tax return, while others give detailed support for much more intricate circumstances, such as self-employment or investment income. Look for platforms that offer real-time error monitoring and advice, assisting to lessen mistakes and guaranteeing conformity with Australian tax legislations.

One more vital aspect to take into consideration is the level of customer support available. Trustworthy platforms need to provide accessibility to help using phone, chat, or e-mail, especially throughout optimal declaring periods. Additionally, study customer testimonials and ratings to assess the overall complete satisfaction and integrity of the system.

Tips for a Smooth Filing Process

Submitting your online tax obligation return can be a straightforward process if you comply with a couple of crucial pointers to guarantee efficiency and precision. This includes your revenue statements, receipts for deductions, and any other pertinent documentation.

Next, take advantage of the pre-filling feature used by numerous on the internet systems. This can save time and reduce the possibility of blunders by automatically populating your return with information from previous years and information provided by your company and monetary establishments.

Furthermore, double-check all entries for precision. online tax return in Australia. Errors can result in delayed refunds or problems with the Australian Tax Office (ATO) Ensure that your personal information, income numbers, and reductions are right

Be mindful of deadlines. If you owe taxes, filing early not just reduces stress and anxiety but additionally permits for far better planning. If you have concerns or uncertainties, get in touch with the assistance sections of your picked platform or look for professional guidance. By following these suggestions, you can navigate the online tax return procedure efficiently and with confidence.

Resources for Assistance and Support

Navigating the complexities of visit this website on-line tax obligation returns can in some cases be overwhelming, however a variety of sources for aid and support are readily available to help taxpayers. The Australian Tax Office (ATO) is the key resource of details, using detailed visit their website guides on its web site, including Frequently asked questions, instructional videos, and live chat alternatives for real-time support.

In Addition, the ATO's phone assistance line is available for those that like direct communication. online tax return in Australia. Tax obligation experts, such as authorized tax obligation representatives, can also offer customized support and guarantee compliance with current tax laws

Conclusion

Finally, effectively browsing the on the internet income tax return procedure in Australia needs an extensive understanding of tax commitments, best site meticulous prep work of essential papers, and careful selection of a suitable online system. Complying with practical tips can enhance the filing experience, while readily available resources offer important help. By coming close to the process with diligence and focus to information, taxpayers can ensure compliance and take full advantage of potential advantages, eventually adding to an extra reliable and successful tax obligation return result.

As you prepare to submit your on the internet tax obligation return in Australia, choosing the appropriate system is necessary to ensure accuracy and convenience of usage.In final thought, efficiently browsing the online tax obligation return procedure in Australia needs a comprehensive understanding of tax obligations, careful preparation of crucial records, and careful selection of an appropriate online system.

Report this page